ICBC has stated the following with respect to how wrongful deaths are dealt with under the new legislation and regulations:

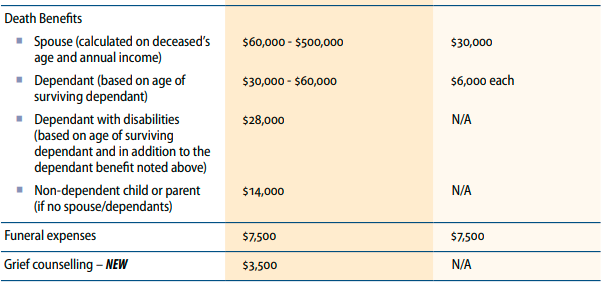

“The final benefit amounts under Enhanced Care, launching May 1, 2021, still need to be confirmed in regulations. Government has issued an intentions paper which includes a section that lays out the death benefits under the current system and the benefits that are proposed for Enhanced Care as follows:

“The new grief counselling benefit under Enhanced Care will help pay counselling expenses for grieving family members and loved ones.

“The Enhanced Care legislation (Bill 11, s. 159) also states that subject to regulations, ‘if a deceased has no spouse and no dependant on the day the deceased dies, each child and parent of the deceased is entitled to a lump sum death benefit in the prescribed amount.’

“This means if there is no spouse or dependent children, but there are adult children or parents, they will receive the death benefits set out in regulation.”

Here are the problems that our Society has identified with this No-Fault legislation specifically in conjunction with the current Family Compensation Act legislative framework:

First off, referring to “No-Fault” as “Enhanced Care Coverage” is essentially Orwellian doublespeak, and is an insult to the intelligence of the average person. This is a pure No-Fault system that provides complete legal immunity to ICBC and places the individual entirely subordinate to the administrative bureaucracy of this crown corporation.

Secondly, when someone is injured or killed by a negligent or reckless individual/entity, they should be entitled to sue for “damages”. Under No-Fault, you can no longer sue. The “damages” are now called “benefits”. “Damages” are set by the courts by case law. “Benefits” are set out in a prescribed meat chart by bureaucrats as if British Columbians are livestock.

Thirdly, they minimize and misrepresent the pre-No-Fault damage amounts available for the surviving family members of breadwinners and pretend like it’s magically much more now. When in fact that class of pecuniary damages are entirely the same in instances where the victim in the pre-No-Fault system was not at Fault.

Fourthly, when the victim was not a breadwinner, there has been no acknowledgement of the non-pecuniary damages relating to damages to the surviving family members for the loss of care, guidance, love, and affection. Allow us to illustrate this using the Chelsea James scenario.

Synopsis

Chelsea was on a party bus with a faulty door that had previously failed inspection numerous times. Somehow it recently passed inspection despite its history of failing. The door had no safety latches, would open randomly while the vehicle was in motion, and all previous repairs to the door were done incorrectly and with the wrong parts. The passengers the night of her death warned the driver about the faulty door before they left and the driver ignored the issue. The driver when approaching the destination took a hard-left turn. Chelsea fell down the stairwell while the vehicle was in motion, the faulty door opened, and she fell through the door and was run over by the bus. She died instantly.

Under the pre-No-Fault ICBC model:

Chelsea’s family was entitled to $7,500 in funeral expenses. That was it. No access to justice, or accountability to the negligent wrongdoers.

If we take this same situation and apply a variation of another province’s legal framework, say Ontario, this is how it would have played out:

While Ontario has provisions of No-Fault under their insurance system, the James family could have still brought forth an “At-Fault” wrongful death claim and sued the driver (ICBC), the company (private liability insurance), the CVSE approved inspection facility who passed it (private liability insurance), and the CVSE / provincial government (self-insured). The top case law verdict in Ontario for loss of care, guidance, and companionship damages has been set at $250,000 per surviving immediate family member claimant. For illustration purposes, each surviving parent would have been entitled to $250,000 for loss of companionship damages, say perhaps $125,000 for Chelsea’s surviving brother, and her two living grandparents at $75,000 each. The total loss of companionship damages available would have been potentially in the ballpark of $775,000.

Regarding punitive and exemplary damages, the Supreme Court of Canada has upheld this at the $1M mark. Let’s just say that Chelsea’s case went before a jury trial, and they assessed a financial penalty of another $500,000 based on the egregious conduct of the driver having been told about the faulty door before they all left, the company knowing about the faulty door, and the CVSE-approved inspection facility passing it, when it had previously failed. Accordingly, the total damages could potentially be $1,275,000 + funeral costs + trial costs.

This would have been likely spread across the insurance of all negligent parties involved. This would have set a precedent to ensure people and entities don’t conduct this type of gross negligence in the future. This would save lives and accordingly it would save costs over the long term through the general deterrence mechanism of pro-active prevention.

However, under the new ICBC No-Fault model this is how it would play out:

There would be no ability to sue anyone to obtain any accountability. ICBC would pull out their No-Fault meat chart and pay a “benefit” of $28,000 to Chelsea’s parents, $14,000 to Chelsea’s brother, $7,500 for the funeral, and $3,500 for “grief counselling” to help the family “get over it”. Total amount of “benefits”: $53,000.

This is roughly 1/24th of the available damages under this illustrative example that would otherwise be available in other Canadian jurisdictions.

Moreover, under the No-Fault model there is still zero access to justice for the family, or accountability for wrongdoers.

Zero financial deterrence for the wrongdoers and others in the industry to not make the same negligent and reckless mistakes in the future.

Why does ICBC continue to lobby the government to limit access to justice and the rights of victims, and their surviving family members?

It is known that ICBC was intimately involved in blocking the 2011 Private Member’s Bill brought forward by MLA Ralph Sultan to modernize BC’s wrongful death laws. ICBC had closed door meetings with the Liberal Cabinet and provided reports and figures that have been withheld from public scrutiny. We suspect similar discussions have been actively taking place with the current NDP government.

Contrary to popular belief, ICBC doesn’t have merely an accounting problem, despite what Ernst & Young may have suggested in their previous reports. The fact is that ICBC has nearly double the workforce as any private insurer of the same customer base size. The crown corporation conducts numerous bureaucratic administrative functions that should otherwise be undertaken by the provincial government. ICBC could never compete in a private free market system, as it is not structured in its workforce operations; it has limited focus on root cause prevention; it is not innovative in its insurance products, services, and delivery; and it has a very poor customer service record.

ICBC is threatened by the modernization of the province’s wrongful death laws, as it further exposes the mismanagement of this crown corporate bureaucracy by both its executive and government, when compared to other jurisdictions across Canada and internationally. The provincial government is threatened as it would expose the administrative functions conducted by ICBC that it should otherwise be responsible for.

The Healthcare Protection Program / Risk Management Branch / Ministry of Finance is also threatened, as they perform in a culture of coverup with limited root cause prevention analysis in our healthcare system.

In the alternative, many independent non-profit public advocacy groups, such as the Canadian Taxpayers Federation, The BC Libertarian Party, and several other independent business trade associations have proposed to convert ICBC to a member-owned co-op and return driver licensing and road safety to the provincial government. ICBC, as a member-owned co-op, would be required to compete in the free market with other private insurers to allow for innovation and competitive rates in a market system.

A market insurance system would free up our legislators to work in the interests of the public in focusing on protecting human life by enshrining legislative protections into law, within the scope of driver licensing and road safety. This would allow insurers to adapt accordingly, thus incentivizing safer standards and protocols to prevent wrongful death in the first place, while keeping rates competitive. These fresh ideas have been greatly resonating with the public and continue to rapidly flourish.

Call to Action

Please petition your MLA to modernize BC’s wrongful death laws »

Further Reading

The History of No-Fault in BC – No-Fault May be the Most Discriminatory Piece of Legislation Ever Proposed in BC… And it’s Back Again!

What Would Work Better Than No-Fault – A Strategic Approach to Road Safety – How to Shore Up ICBC Financially by Focusing on Root Cause Prevention

‘In Their Name’ is the campaign of ‘The BC Wrongful Death Law Reform Society’ – a BC registered non-profit organization comprised of volunteer families who have lost a loved one to wrongful death in BC and were denied access to justice. In response to the biggest human rights issue facing the province today, our goal is to modernize British Columbia’s antiquated wrongful death legislation, which predates confederation (1846). Under current legislation, the value of a human life is measured only by the deceased’s future lost income, so long as they had dependents.

‘In Their Name’ is the campaign of ‘The BC Wrongful Death Law Reform Society’ – a BC registered non-profit organization comprised of volunteer families who have lost a loved one to wrongful death in BC and were denied access to justice. In response to the biggest human rights issue facing the province today, our goal is to modernize British Columbia’s antiquated wrongful death legislation, which predates confederation (1846). Under current legislation, the value of a human life is measured only by the deceased’s future lost income, so long as they had dependents.